Explore web search results related to this domain and discover relevant information.

Here's what to know about the state of repayment plan options for those with federal student loans. The Biden administration rolled out SAVE, or the Saving on a Valuable Education plan, in 2023, promising many borrowers that they'd see their monthly bills drop by half.

SAVE was a new income-driven repayment plan, also called an IDR. Congress created the first IDR plans in the 1990s with the goal of making student loan borrowers' bills more affordable.The best option for many borrowers looking for another affordable repayment option now that SAVE is unavailable is the Income-Based Repayment plan, or IBR, experts said. IBR is also an income-driven repayment plan. Under the terms of IBR, borrowers pay 10% of their discretionary income each month — and that share rises to 15% for certain borrowers with older loans.But student loan borrowers never got the promised lower payments under SAVE.The Education Department said earlier this summer that it was pausing the loan discharge component on IBR while it responds to court decisions over SAVE.

Since then, the loans have remained in forbearance. SAVE will officially end in July 2028, as part of a larger overhaul of the government's student loan program that includes ending new applications for the Income-Contingent Repayment (ICR) Plan and the Pay As You Earn (PAYE) Plan.

Launched by the Biden administration in 2023, SAVE was intended to give borrowers an affordable path to repaying student loans. But it's been in limbo since last summer, when federal courts blocked it in response to a lawsuit from GOP state attorneys general.Since then, the loans have remained in forbearance. SAVE will officially end in July 2028, as part of a larger overhaul of the government's student loan program that includes ending new applications for the Income-Contingent Repayment (ICR) Plan and the Pay As You Earn (PAYE) Plan.But the 7.7 million borrowers on SAVE should start making payments or change plans now, he added, or they could be paying thousands more in compound interest. "Let's say you've got a loan balance of $100,000 with a 7% rate, which isn't uncommon for some people who went to grad school," Melendez told CNBC Select.If you're currently on the SAVE plan, Melendez said, see if it's better to switch plans now, refinance or continue with the SAVE plan until the 2028 drop-off point. "Calculate the results for each strategy," he added. "In which scenario are you going to pay the least over the lifetime of the loan?

Complete the Free Application for Federal Student Aid (FAFSA) form, apply for financial aid before the deadline, and renew your FAFSA form each school year.

Our most likely timeline estimate for the end of SAVE have always been a July 2026 transition date, and based on what borrowers are reporting in their loan portals, this seems likely. For example, this borrower screenshot shows a SAVE end date of 6/19/2026.

The repeated extensions are not accidental. The SAVE plan was permanently blocked by the courts, with the 8th Circuit Court of Appeals officially preventing loan servicers from resuming payments under the plan.It's a blessing for those unable to resume student loan payments due to budget concerns. But it can be a curse for those looking for loan forgiveness - as the SAVE forbearance does not directly count for PSLF, and does not count for long term loan forgiveness.Borrowers on the Saving on a Valuable Education (SAVE) plan continue to not have to make payments on their student loans.Wildcard Timelines: The law requires SAVE, PAYE, and ICR to end by June 2028, but keeping borrowers in forbearance that long would create major operational challenges for loan servicers.

This blog explains what the bill will mean for current and future student loan borrowers and lays out when those changes will likely occur. The Big Bill creates a new income-driven repayment plan. The Big Bill will end the SAVE Plan and other income-driven repayment plans, leaving only the ...

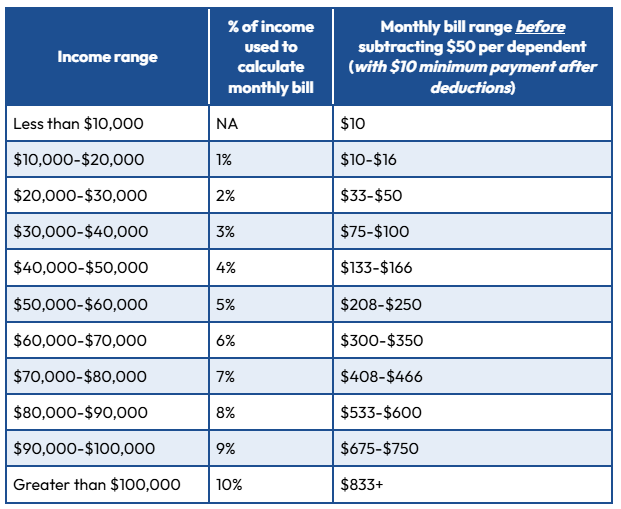

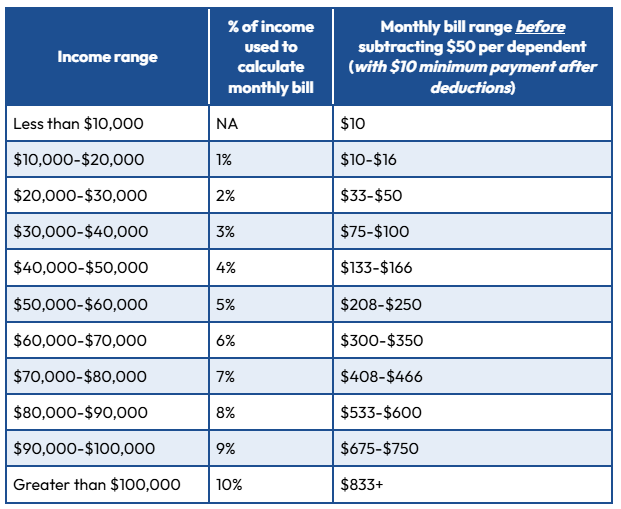

This blog explains what the bill will mean for current and future student loan borrowers and lays out when those changes will likely occur. The Big Bill creates a new income-driven repayment plan. The Big Bill will end the SAVE Plan and other income-driven repayment plans, leaving only the Income-Based Repayment (IBR) Plan and RAP Plans after July 1, 2028.Unlike the existing IDR plans, even the poorest student loan borrowers must make a minimum payment of at least $10 a month, regardless of whether or not they fall below the federal poverty line and regardless of their family size. Monthly payments will be calculated as a percentage of the borrower’s total income (using adjusted gross income, or AGI) minus $50 per month per dependent: · Like the SAVE plan, the RAP plan will waive any interest not covered by the borrower’s monthly payment.In addition to creating a new IDR plan, the Big Bill instructs the Department of Education to eliminate the PAYE, ICR, and SAVE plans by July 1, 2028 – and it could happen sooner. After those plans are eliminated, borrowers whose loans were all disbursed before July 1, 2026 will have the following repayment options:For most borrowers, the required monthly payments in these plans will be significantly higher than payments in the SAVE Plan. This will therefore be an expensive change for many borrowers to deal with. · The Bill makes small changes to the Income-Based Repayment plan so that more existing borrowers will be eligible for it. As a result of the Bill, borrowers no longer have to show that they have a “partial financial hardship” to be eligible for the plan. Additionally, as discussed below, the Bill will allow certain Parent PLUS loan borrowers to enroll in IBR – though they’ll have to jump through hoops first.

The newest income-driven repayment plan, Saving on a Valuable Education (SAVE), is on hold. SAVE borrowers are in an indefinite payment pause, but interest will start building Aug. 1.

SAVE payments paused, interest starts accruing Aug. 1: Administrative forbearance 101 · Still want to sign up for IDR? Online applications reopen · Confused about repayment options? Get student loan helpHowever, lawsuits filed by Republican-led states forced the Education Department to temporarily suspend the SAVE plan in July 2024. Student loan servicers have put SAVE borrowers in an indefinite administrative forbearance while the legal situation is sorted out.Other IDR plans require borrowers to pay at least 10% of their discretionary income each month. Under the SAVE plan, income-driven repayment for undergraduate loans would be set at 5% of discretionary income.Under other IDR options, borrowers are eligible for forgiveness of their remaining student loan balance after 20 or 25 years under current IDR plans, regardless of how much money they took out for school. However, the SAVE plan cuts that down to 10 years for borrowers with principal loan balances of $12,000 or less for undergraduate or graduate study.

Student loan borrowers enrolled in the interest-free SAVE forbearance will soon see their debt begin to grow again, the Trump administration says.

Millions of federal student borrowers whose loans have been in an interest-free pause will see that relief come to an end within weeks. The Trump administration announced on July 9 that the so-called SAVE forbearance will expire on Aug.Forbearances are a period during which federal student loan borrowers are excused from making payments. The Trump administration has called the SAVE plan illegal. In the announcement ending the pause, it said the Education Dept.Former President Joe Biden rolled out the SAVE plan in the summer of 2023, describing it as "the most affordable student loan plan ever."Nearly 7.7 million federal student borrowers enrolled in the Biden-era Saving on a Valuable Education, or SAVE, plan, the Education Department said in its press release earlier this month.

Student loan borrowers stuck in SAVE face three main paths, with payments likely resuming as early as late 2025, but more likely in mid 2026.

The timing of repayment for SAVE borrowers is possible in late 2025, but more likely by mid-2026. The future of student loan repayment for SAVE borrowers is now caught between a pending court ruling and how quickly the Department of Education can execute on the One Big Beautiful Bill (OBBB) that just passed.The Department of Education keeps borrowers in forbearance until migration in mid-2026: The Department of Education simply migrates all borrowers on SAVE to amended IBR by July 2026, coinciding with the RAP plan beginning. Other Timelines: Literally any timeline could happen between December 2025 and June 2028. But it would be rare to keep borrowers in forbearance until 2028, and logistically it would be a nightmare for loan servicers NOT to coordinate with the other changes happening.It seems the most reasonable that this could be an easy coordination for both timing, communication, and execution to have the SAVE borrowers begin payments at this time. We don't view it likely that borrowers who've already been told they are in forbearance until November 2025 would see that timeline shortened. When you also combine that with the logistical workload required to migrate 7-8 million student loan borrowers in SAVE, again, mid-2026 seems more realistic.Then they have to coordinate with the loan servicers to get them going as well. These things take time, effort, manpower (which the Department is lacking), legal analysis, and more. Regardless, the 7 to 8 million borrowers in SAVE will have to make some decisions with their loans in the next six to twelve months.

As interest resumed on $1.7 trillion ... risk across financial markets, particularly for student loan-backed securities (SLABS) and lenders reliant on federal guarantees. The resumption of interest accrual under the SAVE Plan has directly impacted SLABS valuations....

As interest resumed on $1.7 trillion in federal loans, delinquency rates surged from below 1% to 31% by Q1 2025, with Southern states like Mississippi (44.6%) and Alabama (34.1%) bearing the brunt of the crisis [1]. This collapse, coupled with the Trump administration’s new Repayment Assistance Plan (RAP), has triggered a reevaluation of risk across financial markets, particularly for student loan-backed securities (SLABS) and lenders reliant on federal guarantees. The resumption of interest accrual under the SAVE Plan has directly impacted SLABS valuations.With 282 million dollars in collections already received on defaulted loans [2], the financial burden on the federal government—and by extension, taxpayers—is growing. Meanwhile, regional banks in high-delinquency markets are exploring distressed asset acquisitions and financial wellness programs to mitigate losses [4]. The collapse of the SAVE Plan and the rise of the RAP plan mark a pivotal shift in the student loan landscape.- Lenders like Sallie Mae face rising write-downs while fintechs exploit refinancing opportunities amid $282M in defaulted loan collections. The collapse of the Biden-era Saving on a Valuable Education (SAVE) Plan in August 2025 has sent shockwaves through the U.S.- Biden-era SAVE Plan's 2025 collapse triggered 31% student loan delinquency spikes, with Southern states like Mississippi (44.6%) hardest hit.

Back-to-school season has kicked off with anxiety for more than 42 million people carrying federal student debt. The federal government holds 91.6% of all student loans in the country. President Donald Trump is shutting down the SAVE (Saving on a Valuable Education) program, established in ...

Back-to-school season has kicked off with anxiety for more than 42 million people carrying federal student debt. The federal government holds 91.6% of all student loans in the country. President Donald Trump is shutting down the SAVE (Saving on a Valuable Education) program, established in 2023 under the Biden administration.I'm 49 years old and have nothing saved for retirement — what should I do? Don't panic. Here are 6 of the easiest ways you can catch up (and fast) Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it · No more forgiveness. As Forbes reports. On Aug. 1, the clock started ticking again on federal student loan interest.SAVE allowed borrowers to make payments based on income and suspend payments if they didn’t earn sufficient money. For those with undergrad degrees, payments were capped at 5% of discretionary income. The program encouraged borrowers to make regular loan payments by freezing interest as long payments were made monthly — and fully forgave federal student debt after 10 years of regular payments.According to CNET, a borrower earning $60,000 a year could see their $217 monthly payments on a $30,000 student loan under SAVE jump by an additional $100 per month under the Trump administration's student loan plans.

Our most likely timeline estimate for the end of SAVE have always been a July 2026 transition date, and based on what borrowers are reporting in their loan portals, this seems likely. For example, this borrower screenshot shows a SAVE end date of 6/19/2026.

The repeated extensions are not accidental. The SAVE plan was permanently blocked by the courts, with the 8th Circuit Court of Appeals officially preventing loan servicers from resuming payments under the plan.It's a blessing for those unable to resume student loan payments due to budget concerns. But it can be a curse for those looking for loan forgiveness - as the SAVE forbearance does not directly count for PSLF, and does not count for long term loan forgiveness.Borrowers on the Saving on a Valuable Education (SAVE) plan continue to not have to make payments on their student loans.Wildcard Timelines: The law requires SAVE, PAYE, and ICR to end by June 2028, but keeping borrowers in forbearance that long would create major operational challenges for loan servicers.

Student loan borrowers who don't leave the so-called SAVE payment pause could see their debt grow from interest and find their progress to loan relief stalled.

However, the Trump administration has resumed charging these borrowers interest on their loans. As a result, staying put in the forbearance can lead your balance to grow. Borrowers who stay in SAVE are also stalled in their progress to loan forgiveness.Staying in the SAVE forbearance will be costly, with interest accruing again as of Aug. 1. A typical borrower could see their federal student debt grow by $219 a month in interest charges alone if they stayed put in the payment pause and make no payments,, according to calculations from higher education Mark Kantrowitz. More from Personal Finance: Trump floats tariff 'rebate' for consumers Student loan forgiveness may soon be taxed again Student loan borrowers — how will the end of the SAVE plan impact you?That assumes they owe the average outstanding federal student loan balance of around $39,000, and have the average interest rate of roughly 6.7%. "If they stay in forbearance, it will just dig them into a deeper hole," Kantrowitz said. Borrowers who stay enrolled in the SAVE forbearance won't make any progress toward student loan forgiveness.That includes those pursuing the Public Service Loan Forgiveness program. It's another reason to switch plans: Each monthly payment you make under a currently available income-driven repayment plan will likely bring you closer to debt cancellation. IDR plans cap borrowers' monthly bills at a share of their discretionary income, with the aim of making payments affordable, and lead to debt erasure after a certain period — typically 20 years or 25 years. "Hanging out in that [SAVE forbearance] status means losing time towards that goal," said Betsy Mayotte, president of The Institute of Student Loan Advisors, a nonprofit that helps borrowers navigate the repayment of their debt.

Federal student loan borrowers enrolled in SAVE enjoyed 12 months of paused interest. Now, borrowers in certain states will see balances grow very quickly.

Yes, ending SAVE’s interest-free forbearance is tantamount to last call. Except in this case, borrowers don’t just pick up their tab — their outstanding balance is going to increase suddenly and significantly. Unfortunately, it affects federal loan-holders nationwide.Borrowers across 11 states will see at least $300 in interest accrue per month onto their balance — or $3,600 per year — until they exit SAVE or they’re forced to switch to another plan. Borrowers residing in seven states will face monthly interest charges of up to $250. We’re watching three key battlegrounds that will determine the future for student loan borrowers.We already knew that, coincidentally or not, student loan delinquency is worst in states that voted for President Trump in the 2024 election. The end of SAVE doesn’t help borrowers residing in any state, regardless of whether it’s red or blue.The reason for the higher payments is that SAVE called for just 5 percent of your discretionary income for undergraduate loans (or 10 percent for graduate or professional loans, or a weighted average if you have both) — and IBR’s minimum dues equate to 10 percent of your discretionary income.

Interest on SAVE loans resumed Aug. 1. If you're one of the 7.7 million Americans who need to change plans, here are three options.

Launched by the Biden administration in 2023, SAVE was intended to give borrowers an affordable path to repaying student loans. But it's been in limbo since last summer, when federal courts blocked it in response to a lawsuit from GOP state attorneys general.Since then, the loans have remained in forbearance. SAVE will officially end in July 2028, as part of a larger overhaul of the government's student loan program that includes ending new applications for the Income-Contingent Repayment (ICR) Plan and the Pay As You Earn (PAYE) Plan.But the 7.7 million borrowers on SAVE should start making payments or change plans now, he added, or they could be paying thousands more in compound interest. "Let's say you've got a loan balance of $100,000 with a 7% rate, which isn't uncommon for some people who went to grad school," Melendez told CNBC Select.If you're currently on the SAVE plan, Melendez said, see if it's better to switch plans now, refinance or continue with the SAVE plan until the 2028 drop-off point. "Calculate the results for each strategy," he added. "In which scenario are you going to pay the least over the lifetime of the loan?

Interest has started up again for millions of borrowers, and for many, the first step is figuring out where their loans stand. Consumer Reports breaks down what to do and how to stay on track. Almost eight million Americans are enrolled in the SAVE repayment plan.

And if you're already struggling to repay your student loans, that will make things harder in the future. The Student Borrower Protection Center estimates the new interest charges will cost a typical borrower $300 per month or $3,500 a year. The Department of Education says that once the payment pause ends, borrowers will be responsible for monthly payments that include both the principal and any accrued interest. The Department urges those enrolled in the SAVE Plan to quickly transition to an alternative Income-Based Repayment Plan to avoid missing out on important loan benefits.If you've got federal student loans, there are some big changes you need to know about.Carolina Rodriguez, at the Community Service Society of New York, directs a program that helps people with student loans manage their debt. She says many haven't updated their income or repayment plan, which can lead to higher monthly payments.Consumer Reports says to start by logging in to studentaid.gov, the federal student loan portal.

Federal student loan borrowers enrolled in SAVE enjoyed 12 months of paused interest. Now, borrowers in certain states will see balances grow very quickly.

Yes, ending SAVE’s interest-free forbearance is tantamount to last call. Except in this case, borrowers don’t just pick up their tab — their outstanding balance is going to increase suddenly and significantly. Unfortunately, it affects federal loan-holders nationwide.Borrowers across 11 states will see at least $300 in interest accrue per month onto their balance — or $3,600 per year — until they exit SAVE or they’re forced to switch to another plan. Borrowers residing in seven states will face monthly interest charges of up to $250. We’re watching three key battlegrounds that will determine the future for student loan borrowers.We already knew that, coincidentally or not, student loan delinquency is worst in states that voted for President Trump in the 2024 election. The end of SAVE doesn’t help borrowers residing in any state, regardless of whether it’s red or blue.The reason for the higher payments is that SAVE called for just 5 percent of your discretionary income for undergraduate loans (or 10 percent for graduate or professional loans, or a weighted average if you have both) — and IBR’s minimum dues equate to 10 percent of your discretionary income.

Just because the SAVE Plan is on hold doesn’t mean you can’t pursue other avenues for student loan debt relief. Here are a few to consider.

Saving on a Valuable Education (SAVE) plan* in 2023, it promised to make monthly federal student loan payments more affordable for millions of borrowers. But in February 2025, a court order temporarily suspended the plan, leaving more than 8 million borrowers in student-loan limbo.When it first rolled out, the SAVE Plan was touted as a huge step toward mass student loan debt relief in the U.S. But shortly after its launch, a group of Republican leaders filed a lawsuit in the U.S. Circuit Court of Appeals, challenging Biden’s authority to issue such a generous repayment plan without approval from Congress.So, if you’re a SAVE Plan enrollee, you don’t have to make payments until the injunction is lifted, and interest won’t accrue on your principal balance while you wait. The downside is that any payments you make under the SAVE Plan during this time won’t count toward loan forgiveness.If you’ve been struggling to afford your payments, now may be a good time to take a break. After all, interest will not accrue on your loans during the forbearance period, and payments are not required. Plus, any payments you make while enrolled in the SAVE Plan during the forbearance period won’t count toward loan forgiveness either under IDR or

The department said that the 8th U.S. Circuit Court of Appeals decision in February, which blocked the SAVE plan, had other impacts on student loan repayment. For example, under the rule involving SAVE, certain periods during which borrowers postponed their payments would count toward their ...

The department said that the 8th U.S. Circuit Court of Appeals decision in February, which blocked the SAVE plan, had other impacts on student loan repayment. For example, under the rule involving SAVE, certain periods during which borrowers postponed their payments would count toward their forgiveness timeline.With SAVE blocked, borrowers no longer get credit during those forbearances. Ellen Keast, deputy press secretary at the Education Department, said in a late July statement that IBR discharges would resume "as soon as the Department is able to establish the correct payment count." "The federal government does not move very quickly, but I would have expected some progress by now," said Kantrowitz. The hold on IBR discharges shouldn't impact student loan borrowers who are still years away from debt forgiveness, experts said.The U.S. Department of Education told CNBC it paused loan forgiveness under IBR while it responds to recent court actions involving the Biden administration-era SAVE, or Saving on a Valuable Education, plan.More from Personal Finance: Trump floats tariff 'rebate' for consumers Student loan forgiveness may soon be taxed again Student loan borrowers — how will the end of the SAVE plan impact you?

Borrowers in certain states will see balances grow very quickly.

Yes, ending SAVE’s interest-free forbearance is tantamount to last call. Except in this case, borrowers don’t just pick up their tab — their outstanding balance is going to increase suddenly and significantly. Unfortunately, it affects federal loan-holders nationwide.Borrowers across 11 states will see at least $300 in interest accrue per month onto their balance — or $3,600 per year — until they exit SAVE or they’re forced to switch to another plan. Borrowers residing in seven states will face monthly interest charges of up to $250. We’re watching three key battlegrounds that will determine the future for student loan borrowers.We already knew that, coincidentally or not, student loan delinquency is worst in states that voted for President Trump in the 2024 election. The end of SAVE doesn’t help borrowers residing in any state, regardless of whether it’s red or blue.The reason for the higher payments is that SAVE called for just 5 percent of your discretionary income for undergraduate loans (or 10 percent for graduate or professional loans, or a weighted average if you have both) — and IBR’s minimum dues equate to 10 percent of your discretionary income.

Borrowers in certain states will see balances grow very quickly.

Yes, ending SAVE’s interest-free forbearance is tantamount to last call. Except in this case, borrowers don’t just pick up their tab — their outstanding balance is going to increase suddenly and significantly. Unfortunately, it affects federal loan-holders nationwide.Borrowers across 11 states will see at least $300 in interest accrue per month onto their balance — or $3,600 per year — until they exit SAVE or they’re forced to switch to another plan. Borrowers residing in seven states will face monthly interest charges of up to $250. We’re watching three key battlegrounds that will determine the future for student loan borrowers.We already knew that, coincidentally or not, student loan delinquency is worst in states that voted for President Trump in the 2024 election. The end of SAVE doesn’t help borrowers residing in any state, regardless of whether it’s red or blue.The reason for the higher payments is that SAVE called for just 5 percent of your discretionary income for undergraduate loans (or 10 percent for graduate or professional loans, or a weighted average if you have both) — and IBR’s minimum dues equate to 10 percent of your discretionary income.